Payment and Finance: Everything You Need to Know

In the fast growing world of finance, understanding the mechanisms behind payments and transactions is crucial. Whether you're a project owner, an entrepreneur, a seasoned investor, or simply someone looking to manage his personal finances well, you should understand what is a payment and what are the players that enable it locally and worldwide, it's not that hard to understand the fundamentals off finance, banking, payments, and transactions, all you need to grasp is the players and terminology.

To have a healthy business and better serve your customers understand how payment works !

In this guide, we will explain the concepts surrounding finance, demystify everything from the role of financial institutions to the mechanics of payment gateways and money transfert and receiving. So, let's dive into the world of finance.

What is a financial institution?

At the core of every transaction is financial institutions, they are entities enabler that facilitate monetary transactions, investments, and other financial activities (Loans, Insurances, hedge fund, etc ..). They can range from banks and credit institution to investment firms and insurance companies. These institutions play a vital role in the global and local economies by providing financial services such as investing, risk management, providing payment infrastructures and more.

Here are example and types of financial institutions

- Banks: Commercial banks, retail banks, investment banks.

- Insurance Companies: Providers of insurance products and services.

- Investment Firms: Entities responsible of investment management and consulting services.

- Pension Funds: Entities managing retirement funds and investments.

- Hedge Funds: Investment funds dedicated to high-net-worth individuals and institutional investors.

- Venture Capital Firms: Investors providing money to startup companies in exchange for equity.

- Central Banks: Institutions responsible for monetary policies and regulating the banking system in countries.

What is a bank?

A bank is a financial institution that allow individual and companies to acces to financial services, a bank accepts payments deposits and transferts from the public and creates credit. Banks offer a variety of services, including bank accounts, loans, mortgages, insurance and investment products.

The primary service we rely on daily transactions is credit/payment cards, facilitating for purchasing goods and services both online and offline. A bank aldo act as intermediate between depositors and money borrowers, facilitating the flow of funds in the economy.

What is a central bank, and how does it differ from a commercial bank?

A central bank is a financial institution responsible for a a country monetary policy, its role is to regulate the banking system, to oversee players, and to issue local currency. Its primary objectives include maintaining reserves (country wealth, worldwide currencies reserve ..) and price stability, controlling inflation, and enabling economic growth.

Example of CBs: US Federal Reserve (FED), European Central Bank (ECB), People's Bank of China (PBOC), Bank Al Maghreb (BAM) ..

Central banks also serve as providing liquidity to financial institutions and banks during normal and times of crisis (Ex: role of the FED during 2008 crisis).

The key differences between a central bank and a commercial bank lie in their objectives, functions, and ownership structures.

A Central bank focus on country macroeconomic stability and financial regulation on a national scale. A Commercial bank primarily engage in retail and selling financial products to generate profits for their shareholders.

Central banks also have unique powers, such as the authority to issue currency, print money and regulate monetary policy.

How banks obtain certificates?

A Bank become recognized as a financial institution through a process of regulatory approval and compliance with relevant laws and regulations (Generally set by the Central Bank).

A commercial Bank must obtain a banking license from the regulatory authority, the process involves submitting an application detailing the bank's business model, operations, ownership structure, and compliance measures. Regulatory authorities, such as central banks, review these applications and assess whether the bank meets the necessary criteria to operate safely.

Understanding payments and transactions

A payment refers to the transfer of money or value from one entity (personal or company) to another in exchange for goods, services, or obligations (loans). a payment can be in various types, including cash (cashier), checks, credit cards (online payment), and bank transfers.

A payment for a good or service generally is issued after generating and validating an invoice.

On the other hand, a transaction encompasses the entire process of exchanging goods, services, or financial instruments between parties, including the initiation of the payment, authorization (signature, check), transfert (between accounts) and settlement of the payment.

Example:

- Payment of a subscription invoice.

- Transaction: A stripe transaction, is followed with other transactions fees and withdraw to the bank account linked with the payment gateways.

A transactions doesn't necessary have to be a payment for exchange of good, example: transfert of money from the cashier to the bank.

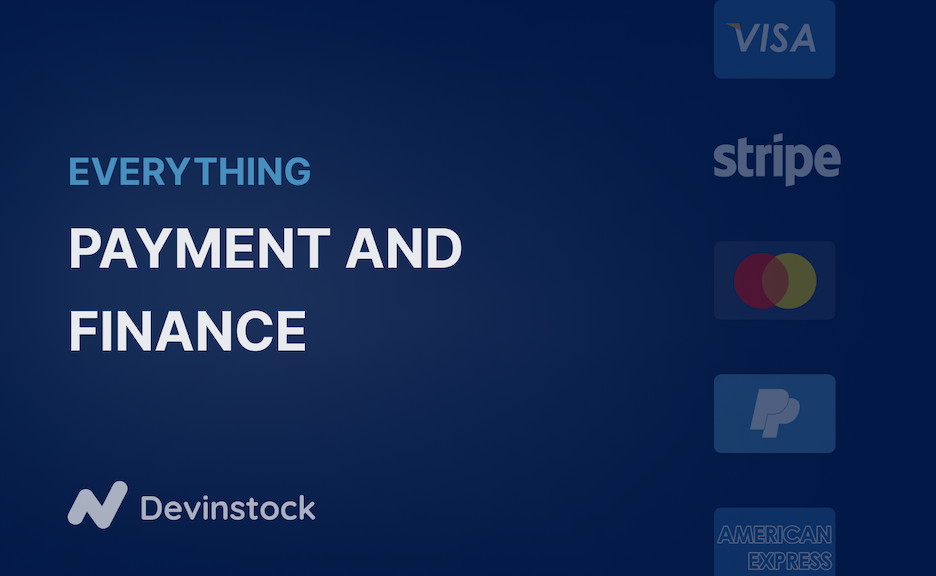

What is an invoice?

An invoice is a business document issued by a seller to a buyer during a Sale or Purchase operation, detailing the products or services provided, along with the corresponding prices, items, quantity, tax, discount and terms of payment. It serves as a formal legal justification for payment and helps track sales and manage accounts collects and expenses.

- Invoice in french is referred as: Facture

- Invoice in arabic is referred as: فاتورة

What are Payment Gateways?

A payment gateway is a technology provider platform that facilitates online payments by securely transmitting payment between a seller website or online service and a financial institution (bank or). A payment Gatway integrate with several banks and offer it services to individual or companies, enabling them to collect payments and integrate through their API (Application Programing Interface).

A PG also ensure security transactions and encrypts sensitive data such as credit card numbers . Payment gateways play a crucial role in enabling e-commerce and online local and worldwide transactions.

Examples of PGs: Paypal, Stripe, Square ..

Undestanding value stores

Value stores refer to assets that preserve purchasing power over time, making them an option for storing wealth. These assets serve as a hedge against any economic uncertainty or inflation. Value stores also gives stability to holders, investors and individuals seeking to preserve or trade the value of their money.

Some common types of value stores are:

Currency: Fiat currencies issued by governments, such as the US dollar, euro, serve as widely accepted stores of value and mediums of exchange and trading.

Commodities: Such as oil, natural gas, agricultural products, and precious metals can serve as stores of value due to their utility nature and role in global economies.

Precious Metals: Gold, silver, platinum, and other precious metals have long been used by humanity as stores of value due to their intrinsic properties, scarcity, and historical significance.

Real Estate: Land or house properties and real estate investments can serve as value stores, offering rental or selling income streams and long-term appreciation potential.

Art and luxury: Fine art, rare collectibles, and luxury goods can also serve as stores of value for high-net-worth individuals.

What is a stock trading?

Stock trading involves buying and selling shares of commodities or stock for publicly traded companies on stock market exchanges. Investors can profit from stock market trading by purchasing the public shares of companies or goods at a lower price and selling them at a higher price. It requires a good knowledge of market trends, financial analytics of companies performances, and risk management strategies.

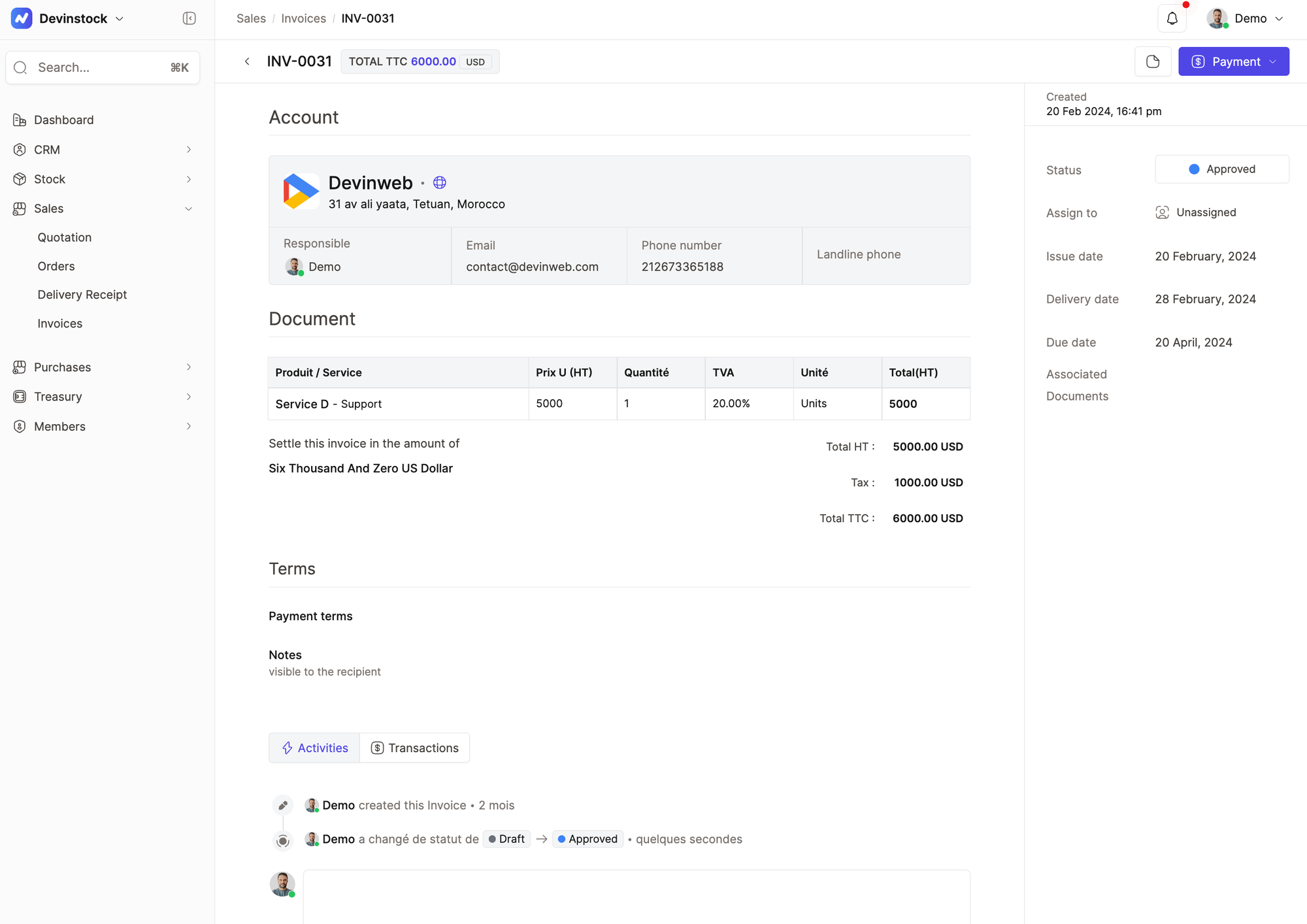

How Devinstock transactions works?

Devinstock make the process of collecting payments, registering invoice and transactions easy, it give you the possibility to create invoices and collect payment regulations. at the suitable currency of your customer. Here an example workflow of regulating an invoice:

First, you'll start by adding your bank accounts, providing detailed information such as the base currency of each account and any intermediate service provider, such as your payment gateway.

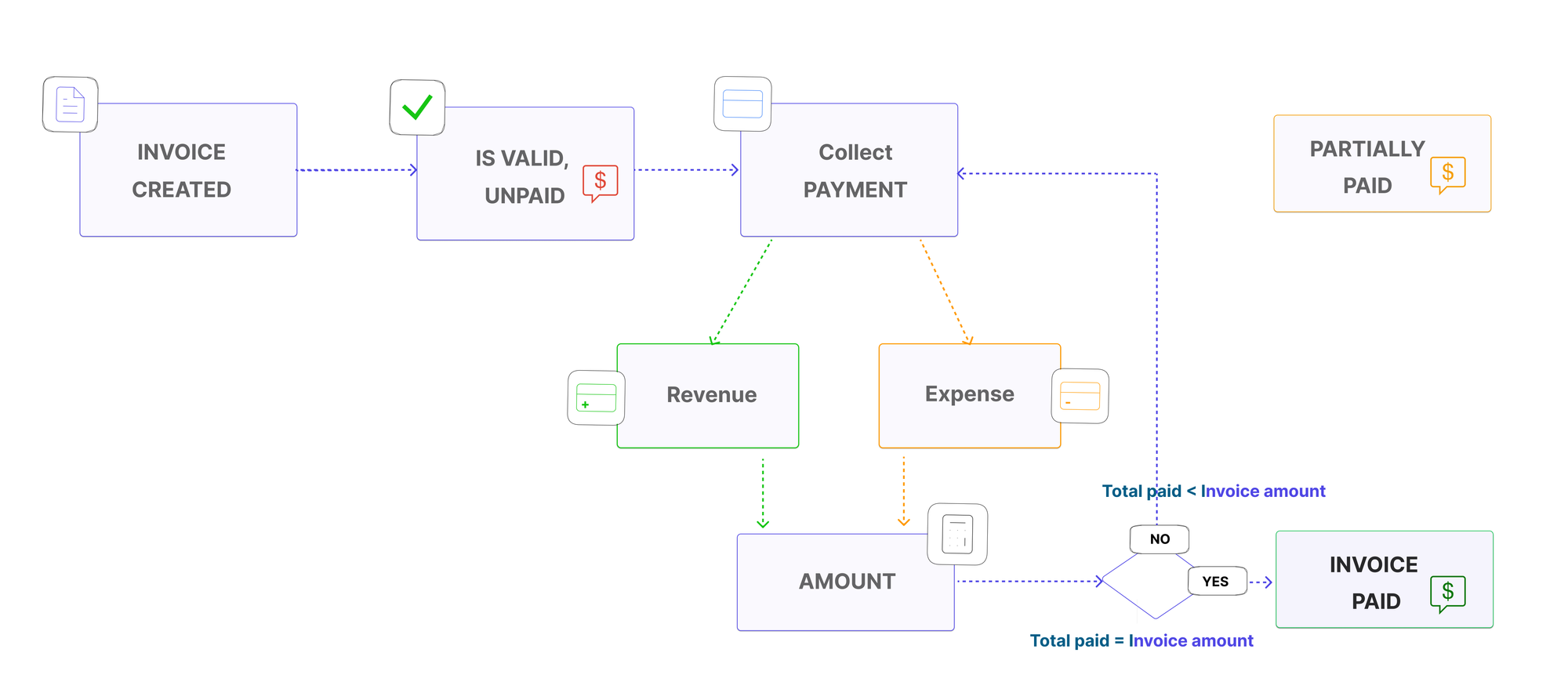

Once the invoice is created, it's saved as draft. You can validate it, and its primary status becomes unpaid. Once validated, you'll start collecting the payment by creating a revenue with the desired amount for regulation. If the payment is partial (amount < invoice amount), the invoice will be partially paid. Once you collect the total invoice amount, the invoice is marked as paid.

You can also add any expenses incurred due to the invoice regulation: ex. delivery fees, bank fees, or Stripe transaction fees

Devinstock allow you to easily

- Add multiple cashier and bank accounts with multi-currency in your workspace.

- Add your banks and PGs to track transactions.

- Regulate customer situation by regulating partial payments of invoices.

- Register fees related to the transaction: example bank or PG fee, etc

- Add revenue and expense with specific types.

- Track and filter transactions by type (Expense, Revenue).

Now, having grasped the fundamentals of finance, you're now good to go to manage you project/product finances with confidence and ease. To learn more about how payment and transactions with Devinstock works, visit our help center, where you'll find everything related to invoices, payments, and transactions

Elevate your business with Devinstock 🚀

The ultimate management tool for Delightful businesses !

- 👨🏻💻 Collaborate with a dynamic team of innovative consultants

- 🌍 Seamlessly integrated CRM for intelligent sales.

- 🖥️ Enjoy a unique and intuitive user experience.

- 📦 Effortlessly migrate your products and accounts.

- 👥 Access a dedicated team to support your success 24h/6.