Mastering your business expenses !

Once upon a time in the land of entrepreneurial dreams, there was a brave business owner named Karim who battled the mighty dragon of expenses. Armed with papers and pens, Karim struggled to keep track of every receipt, bill, and dollar spent.

Nowadays, a magical world of digital tools and strategies emerged, promising to beat the beast of chaotic bookkeeping.

Join Karim on this enlightening journey to discover how modern business owners can keep their expenses in check without losing their sanity.

In this article, we'll explore simple working steps to effortlessly manage your business expenses:

- Establish a dedicated business bank account.

- Organize your business expenses into categories.

- Save and document your receipts and bills.

- Regularly review and update your expense reports!

What are business expenses?

Business expenses are the financial fuel of a company: It covers daily operations, distribution, to marketing and sales campaigns. Think of the expenses cost as the investments you make to keep your business running and growing.

These expenses can be: the cost of products sold, salaries, office supplies, travel, marketing, and more. By managing and optimizing these costs, you can maximize your profitability and reinvest your income in your business's future.

In essence, measuring expenses is not just about minimizing costs—it's about empowering your business to achieve greater heights. A succesful business embrace the expenses as the critical tools that drive success and innovation!

What are important business expenses to track?

Managing expenses efficiently is important for the financial health and growth of your business. Here's the most important common expenses for a succesful business.

Employee salaries and benefits: Monthly salaries, health insurance, retirement plans, and other benefits provided to your staff.

Rent or lease payments: Costs for yout office space, warehouses, or any retail locations.

Marketing and advertising costs: Expenses related to online ads, social media campaigns, email marketing, and promotional branding.

Utilities cost: Paying bills for electricity, water, internet, and phone services.

Office supplies and equipment: Costs for tools and items such as computers, printers, desks, chairs, and any office supplies.

Travel and entertainment: Expenses for business travel or events, including flights, hotels, meals, and client entertainment.

Administrative services: Fees for accounting services, legal consultants, and other professional support.

Insurance: Business insurance, including liability, properties, and employees's compensation.

Tools and subscriptions: Costs for software, website, cloud services, tools for operations.

Depreciation: The reduction in value ever time of your assets, such as vehicles, machinery, and technology equipment.

How to succefuly keep track of your expenses?

Keeping track of business expenses involves utilizing modern tools and practices to ensure accurate, efficient, and organized financial management. Here are some steps and tools to consider.

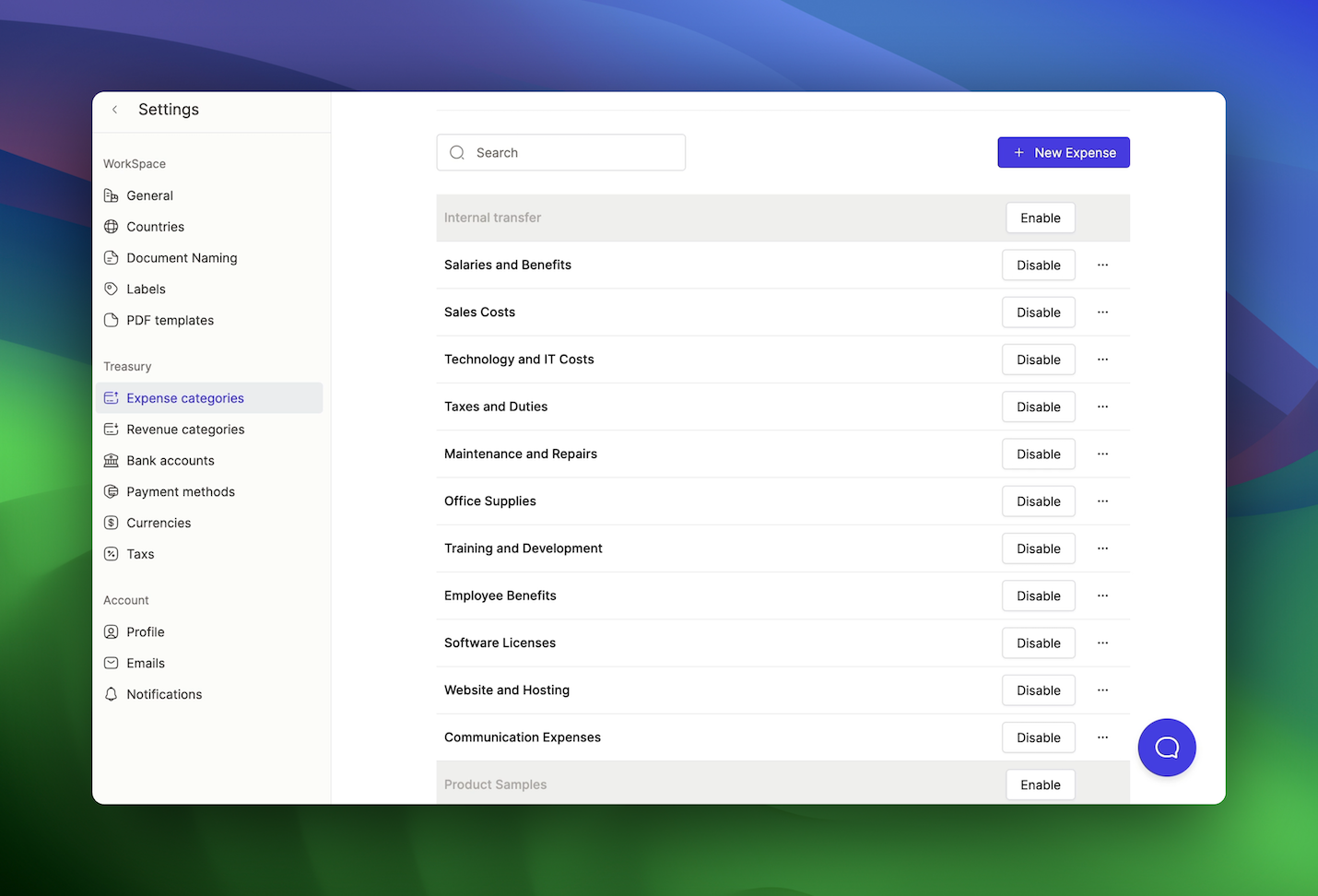

Expense management Software

Use expense management apps like Devinstock, QuickBooks, or Wave. These platforms allow you to track expenses, categorize them, and integrate with your bank accounts for automatic updates.

These softwares can help you manage receipts, bills, and business purchases and costs on the go.

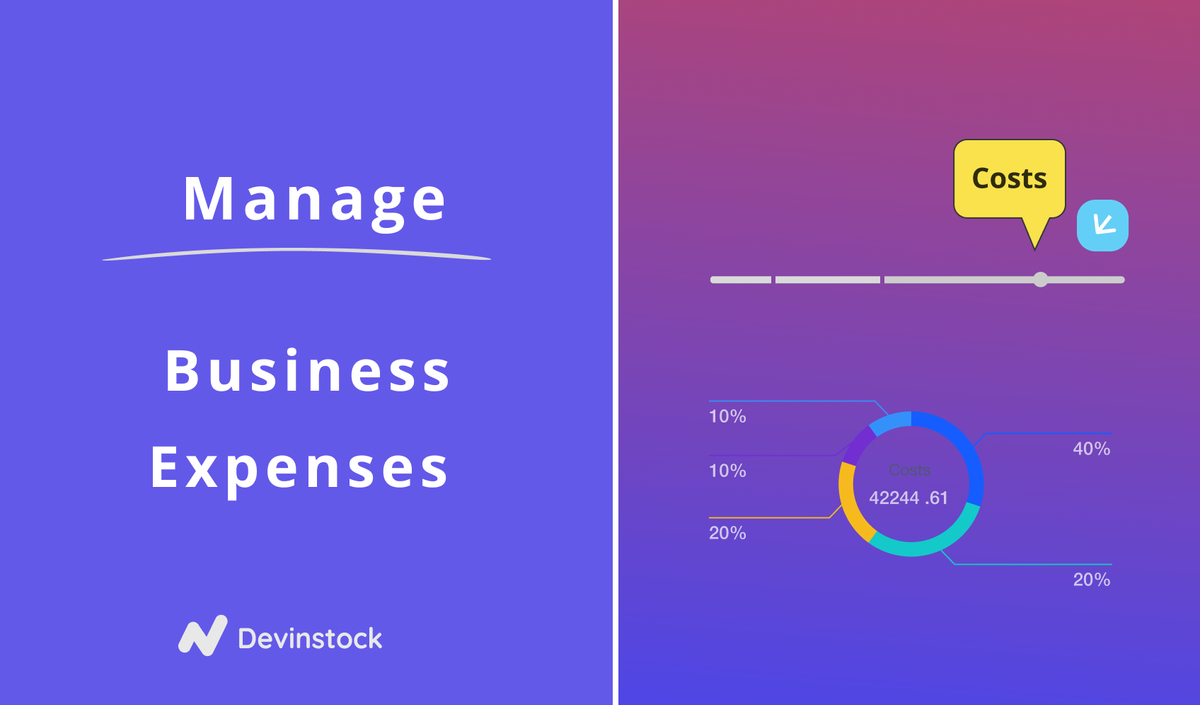

Expenses Category

Set up expense categories in your accounting software that align with your country tax requirements. Regularly review and categorize expenses to ensure accuracy, measure expense % distribution per category.

Create budgets for different expense categories and use your tool to generate regular financial reports. This helps in monitoring spending and making informed financial decisions.

Devinstock allows you to create and manage expense categories easily, so you can track your payments, by simply enabling the ones you want to track !

Create Bank Feeds

Connect your business bank accounts (Ex. Wise, Mercury), payment gateways to receive online payments like (Strip) and credit cards to your accounting software. This automates the import of transactions, reducing manual entry of payments. If you manage a distribution or Point of Sales (POS) you may need to add a cashier account.

If your billing software doesn't implement automatic import or integration you can create banks and cashier manually, set the balance and start to record your transactions.

Create billing and expense docs

Create financial documents such as invoices, payment receipts, and cheques, then store them in your billing management software. Scan and import any older documents to your server or online storage solutions like Google Drive or Dropbox. Ensure that these documents are well-organized and easily accessible for accounting and auditing purposes.

Why should you consider tracking business expenses?

Effective expense tracking is a foundation for sustainable business success and operational efficiency. It's is important because it not only helps in making informed financial decisions but also simplifies tax preparation and compliance, reducing the risk of errors or audits.

Monitoring costs and expenses provides a clear and accurate picture of your company fiances.

By recording every expense, you can monitor cash flow, identify cost-saving opportunities, and ensure that you are staying within your annual budget. .

Having a detailed record of expenses helps in evaluating the profitability of different business activities, enabling strategic planning and growth.

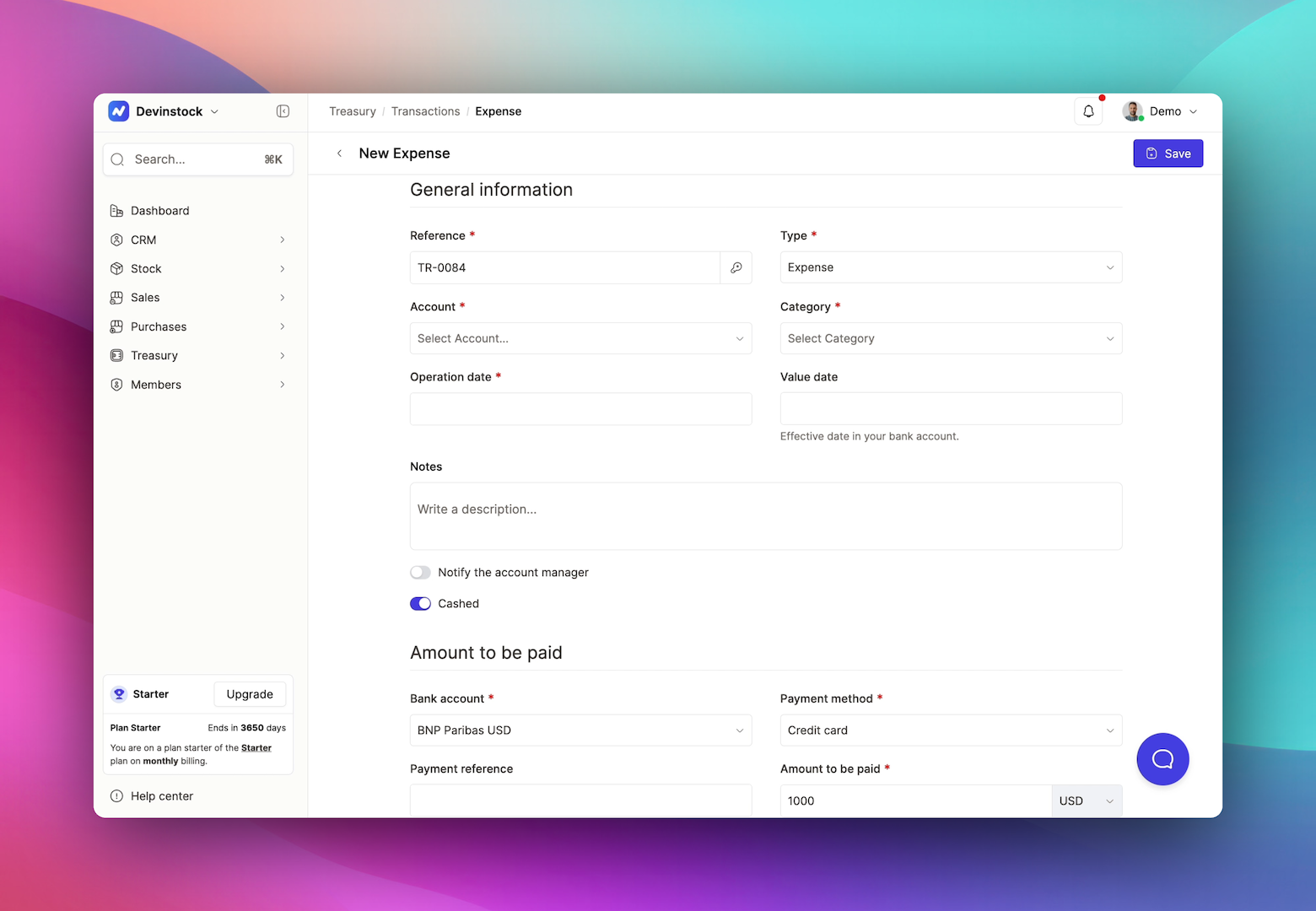

How to create a business expense?

Devinstock’s allow to store and organize financial documents digitally. The user can easily create and master expenses, scan and upload the payment receipts, and attach it to the transaction, ensuring that every expense is documented and accessible. This makes accounting and auditing simpler and save you time and effort !

Conquer the monster of chaotic expense management

The days of battling disorganized receipts and chaotic expense records were finally over. After implementing these essential steps, Karim the entrepreneur can feel the sense of relief and triumph.

Thanks to this expense management strategy, and softwares like Devinstock the business finances are clear and manageable, allowing the entrepreneur to focus on what truly matters: growing the business.

Elevate your business with Devinstock 🚀

The ultimate management tool for professionals !

- 👨🏻💻 Collaborate with a dynamic team of innovative consultants

- 🌍 Seamlessly integrated CRM for intelligent sales.

- 🖥️ Enjoy a unique and intuitive user experience.

- 📦 Effortlessly migrate your products and accounts.

- 👥 Access a dedicated team to support your success 24h/6.